Investing in a Gold IRA can be a strategy to diversify your retirement portfolio.

It’s generally considered a more conservative approach compared to traditional stocks and bonds, as gold has historically been seen as a store of value. Birch Gold Group is one of the many companies that facilitate Gold IRA investments.

However, like any investment decision, it’s important to do thorough research. We always recommend that you consider factors like your investment goals, risk tolerance, and how gold fits into your overall financial strategy.

In this in depth birch gold group review, we look into the company’s reputation, fees, and track record. we discuss whether they are a good company to invest with.

Birch Gold Group;Overview

With their main HQ in Burbank California, Birch Gold Group is well located to offer a gold IRA retirement savings option for the high number of older adults.

Founded in 2003, Birch Gold Group serves clients throughout the U.S., creating and managing gold IRAs holding silver, platinum, palladium, gold, or a combination of these metals.

Their focus on portfolio diversification as a means to protect wealth and purchasing power aligns with the common rationale for investing in precious metals. It’s also notable that they offer services such as gold IRA rollovers, direct purchase of precious metals, and storage options through third-party depositories.

The mention of their team having decades of combined work experience in finance and their commitment to making the gold IRA setup process easy for investors suggests a level of professionalism and expertise in the field.

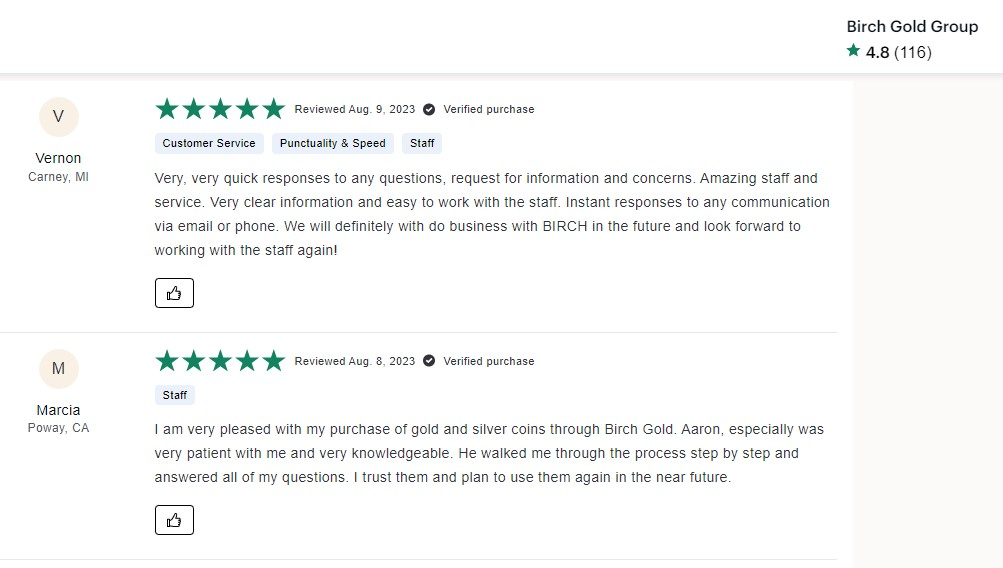

Here are some birch gold group reviews from different consumer protection platforms;

Consumer Affairs – 4.8 out of 5 from 116 reviews.

BCA(Business Consumer Alliance) – AAA rating based on 7 reviews.

Better Business Bureau (BBB) – 4.61/5stars from 109 customer reviews.

6 complaints closed in last 3 years

2 complaints closed in last 12 months

Trustpilot – 3.9 rating from 130 reviews.

P.S We found out they do have a few bad reviews. However, based on previous verified purchasers, their commitment to resolve issues stunningly good.

For us, a comprehensive review goes beyond singular achievements.

It involves placing Birch Gold Group side by side with its industry peers to discern subtle differences that could sway investor decisions.

When compared to Gold IRA companies like Goldco or American Hartford Gold, we found out that while all three exhibit a commitment to customer satisfaction and reliable investment services, the subtle differences in their ratings and reviews provide insights into their respective strengths and areas of expertise. For instance, birch gold group specializes in converting existing IRA’s and eligible 401(k)’s into gold and other physical precious metals investments.

See why Ben Shapiro endorses Birch Gold

What Is a Precious Metals IRA?

If you are new to precious metals investing…

A gold or precious metals IRA (Individual Retirement Account) is a retirement account that allows you to invest in physical gold, silver, palladium, or platinum instead of relying solely on investments in stocks, as many do with a 401(k).

Your precious metals investments are held in an account overseen by a custodian, a trusted financial institution who monitors your investments and manages transactions for the account, such as withdrawals.

Birch Gold Group typically works with either STRATA Trust Company or Equity Trust Company as custodians.

The physical metals you’ve invested in are stored in a depository, where they’re both secure and legal.

Cost for Birch Gold Group Precious Metals IRA

Birch Gold Group clients need a minimum of $10,000 to fund a gold IRA. However, the funds can come from the transfer or rollover of an existing IRA.

We found this to be especially an advantage because it means you can seamlessly transition your retirement funds into a more tangible and potentially stable asset like gold. By utilizing the option to transfer or rollover an existing IRA, Birch Gold Group opens doors for investors to safeguard their retirement savings from the market volatility of traditional financial markets.

In addition to the starting funds, some nominal fees will be associated with opening and maintaining your investment account.

You’ll pay a one-time account setup fee of $50 at Birch Gold Group and a $30 wire transfer cost. There are also continuing expenses that clients will need to cover. Management fees are $100 per year, and insurance and storage costs total $100 annually.

If you’re transferring more than $50,000 into your new gold IRA, the fees are waived for the first year of service.

Setting Up a Birch Gold Group Gold IRA

The first step is to open a self-directed, gold IRA with existing funds. You can roll over a traditional IRA, Roth IRA, SIMPLE IRA, SEP IRA, or eligible 401(k), 403(b), 457, or TSP accounts to fund your new precious metals IRA.

If you have a different type of fund you’d like to convert to a gold IRA, contact Birch Gold Group to see if your retirement account is eligible.

Once you’ve established your gold IRA, you can begin buying precious metals through your Birch Gold Group specialist. One of the significant benefits of opening a gold IRA through Birch Gold is the IRA specialist you have access to.

Every client who opens an IRA account through Birch Gold receives the advice of a precious metals specialist. The specialist can give you tips on investing strategically to grow your portfolio.

You have four choices of precious metals for your IRA: gold, silver, platinum, or palladium. The specialist can give you details about each and recommend the best investment path for your personal goals.

After you purchase gold or different precious metals, Birch Gold Group will have your assets sent to a depository, which your specialist also helps you choose. From there, a custodian will oversee your investments.

That said, the assistance from Birch Gold Group doesn’t stop. You can consult with your specialist at Birch Gold Group on an ongoing basis about your gold IRA and its performance, ensuring you’re getting the most out of your investments. The company also has a good buyback program in case you ever need to liquidate your precious metals.

Birch Gold Group’s Options for Precious Metal Investments

When choosing a precious metal to invest in, you should consider a few things, such as the type of metal, its current market value, and how likely the metal is to increase in value over time.

While gold may seem like the obvious choice for investing, silver, platinum, and palladium have pros as well. Keep in mind that any precious metal investment must be approved for your precious metals IRA, which is where Birch Gold Group plays an important role.

To make finding IRA-approved precious metals easier, Birch Gold Group clearly labels each IRA-approved precious metal product on its site.

Gold

Gold is a valuable resource that has been used for centuries as a form of currency. It is a physical asset that can be stored and retrieved easily, making it a desirable investment choice. Gold is also a wise investment for many people because it is typically less volatile than silver.

One-ounce gold coins are popular for investors because they are easy to trade and transport. American Gold Eagle and Canadian Maple Leaf coins are two examples of commonly purchased one-ounce coins. However, many different weight choices and types of gold coins are available.

Silver

There are a few reasons why you may choose to invest in silver instead of gold. One reason is that silver is cheaper than gold, so it may be a more affordable option for investors.

It’s also more closely tied to the industrial market and dependent upon the market’s ups and downs, making it more volatile than gold. Some investors wish to avoid volatility. However, volatility and closer market ties are preferable for investment portfolios of others.

Another reason silver makes a reasonable investment is that some believe silver will experience greater price appreciation than gold in the future.

Palladium and Platinum

It’s essential to have a diverse selection of investments in any portfolio, and palladium and platinum are often fantastic metals for rounding out a self-directed IRA.

Palladium is a rare metal and a valuable resource used in producing catalytic converters, jewelry, dentistry, and medical equipment. Palladium is also used in the manufacturing of aircraft engines and electronics.

Investors buy palladium because its many uses mean demand for the metal is likely to increase as time goes on.

Similarly, platinum is a white metal that is often used in jewelry, laboratory equipment, and other cutting-edge technology. Platinum is actually rarer than gold, but at this point in time, it’s not quite as valuable.

Platinum is a volatile investment, and prices can fluctuate significantly. Before investing in platinum, it is important to do your research and understand the risks involved.

Your Birch Gold specialist will discuss the ins and outs of gold, silver and Palladium and Platinum acquisitions with you to give you an idea of which investment option is ideal for your IRA.

Storage Options for Physical Precious Metals

Birch Gold Group is not a gold storage company. When you buy precious metals through Birch Gold Group, your assigned specialist supplies you with a list of depositories where your physical metals can be safely stored.

The specialist can guide you through the particulars of each storage option and answer any questions you may have so you can select the best depository for you.

Birch Gold Group works with the following depositories.

See also our article on if you can store IRA gold at home.

Delaware Depository

Delaware Depository stores gold, silver, platinum, and palladium. They are one of the most respected and well-recognized depositories in the U.S. This facility is exchange-approved and qualified to hold IRA assets in the form of precious metals for clients. Its clientele includes major banks, investment firms, and businesses.

This depository has an excellent security system and uses highly protected Class 3 vaults to store client investments. It is the largest depository outside of New York City, and its management has over 200 years of combined experience in precious metals.

Those who choose to store their gold or other precious metals at Delaware Depository can keep them in the Wilmington, Delaware location or in Seal Beach, California.

The depository carries $1 billion in “all-risk” insurance coverage through London underwriters, which should give clients peace of mind about the safety and security of their precious metals IRA.

Brink’s Global Services

Brink’s Global Services is an international provider of secure logistics and security solutions. The company offers services in over 100 countries and employs around 74,000 people.

With BGS’s extensive network, clients enjoy plenty of service options and the security that comes with working with a high-profile, trusted market leader. BGS is an IRA-compliant depository that stores any metals approved for IRA investments, typically in the form of silver, platinum, palladium, or gold coins.

Birch Gold Group clients can store their silver, platinum, palladium, or gold investments at the New York City, Los Angeles, or Salt Lake City BGS locations, depending on the custodian of the client’s IRA.

Brink’s Global Services closely guards clients’ investments, which are transported to storage facilities in Brink’s armored vehicles. The vehicles are accompanied by a team of security professionals who are trained to handle and transport precious metals. The company is fully liable for shipping and inspects all shipments upon arrival.

Once your investments are safely stored at a BGS location, they’ll be regularly audited.

Texas Precious Metals Depository

Texas Precious Metals Depository is a popular precious metals depository located in Shiner, Texas. Its non-descript appearance covers an incredibly secure storage facility that rivals the top gold IRA custodians.

The depository offers various services, including storage, shipping, and insurance. All the assets held in the facility are 100% insured against theft and a range of natural disasters and are audited annually. They’re also kept in fully segregated and sealed facilities with constant interior and exterior surveillance, bullet-proof doors, and armed employees.

Several other security precautions, including chain of custody monitoring, ensure that every client’s assets are completely protected at Texas Precious Metals Depository.

Additionally, while your assets are stored at TPMD, they remain yours and are never considered part of the facility’s property. This is to protect your purchases in the case of bankruptcy of the depository.

This gold IRA depository allows clients to visit and see their gold IRA investments in person, which is a great benefit for many Birch Gold Group customers.

Birch’s Buyback Program

One of the most popular features of Birch Gold Group is its buyback program. This program allows investors to sell their precious metals back to Birch Gold Group at any time. While some companies charge fees to buy back precious metals from clients, Birch Gold Group does not.

The process is simple and straightforward, and it’s a great way to get money out of your investment quickly if you need to.

Birch Gold Reviews Online

Over the course of two decades, Birch Gold Group has received many customer reviews, and most of them reflect excellently on the company as a whole. On Google alone, Birch Gold Group has over 220 reviews from clients with an overall rating of 4.9 stars.

The Better Business Bureau has also given Birch Gold Group an A+ rating, the highest possible score.

Many of the positive reviews mention how helpful and knowledgeable the staff at Birch Gold Group are. Customers also frequently note that they feel confident in Birch Gold Group and their investments.

A few complaints mention issues with customer service or difficulties withdrawing money from accounts, but these seem to be in the minority.

Generally, it seems that Birch Gold Group is a reliable and trustworthy company with an excellent reputation.

Pros and Cons of Investing with Birch Gold Group

- Birch Gold Group has an A+ rating from the Better Business Bureau, showing themselves to be a reputable and trustworthy company

- Birch Gold's online customer reviews indicate a majority of satisfied investors

- The precious metals dealer has been in business for almost 20 years, serving clients throughout the United States

- Birch Gold provides each IRA client with a precious metals specialist who delivers 1-on-1 attention to each client and gives exceptional, ongoing customer service

- Interested investors can sign up to receive a free information kit that includes everything they need to know to get started

- Birch Gold Group has a large scope of products for clients to choose from

- The company has a good buyback program

- Some clients note dissatisfaction with their Birch Gold Group IRA in online reviews due to losses and/or customer service issues

- $10,000 minimum investment may be too high for some beginning investors and those wishing to make small purchases

- Customers must call to initiate trades rather than being able to do so online

Birch Gold Group: Frequently Asked Questions

It can be difficult to make investment decisions without all the facts. To help you out, we’ve compiled a list of answers to some of the most frequently asked questions about Birch Gold Group.

Can I Store Physical Gold Bought From Birch Gold at Home?

Storing physical precious metals for your IRA at home isn’t advised due to safety concerns and IRA regulations. When you’re ready to possess your metals upon retirement, the holding depository can safely deliver them to you.

Alternatively, you can sell and receive cash distributions, possibly with associated fees depending on IRA type. Some depositories permit visits to view your metals in person. Inform your Birch Gold specialist if this matters to you, to select a suitable depository. Non-IRA precious metals from Birch Gold can be kept at home without the same legalities. However, caution is advised when storing precious metals at home.

What Are the Risks of Investing in Precious Metals through Birch Gold Group?

Investing in precious metals carries inherent risks despite the safety they generally offer. The same applies when using Birch Gold Group for gold IRAs or other metal investments. The value can decline instead of rise due to the volatility of precious metal prices, impacting the performance of a precious metals IRA compared to other investments.

Yet, historically, the precious metals market has often outperformed other options. Birch Gold Group is recognized for its reliability and customer-friendly approach in the precious metals IRA sector over the long term.

What Is the Minimum Investment for a Precious Metals IRA?

Birch Gold Group requires a minimum investment of $10,000 to open an IRA. There are also one-time account setup and wire transfer fees associated with opening an IRA through Birch Gold, along with annual fees that cover storage, management, and insurance.

How Does Investing in a Precious Metals IRA through Birch Gold Protect a Client’s Wealth?

Precious metals have been used as a form of currency and store of value for thousands of years. Unlike paper money, which is issued by governments and not backed by anything tangible, precious metals have an inherent value. This means that they can never be worth less than the value of the metal itself.

Verdict; Is Birch Gold Group Worth Investing With?

Birch Gold Group offers precious metals investing options, including setting up the gold IRA, helping with rollovers, and providing guidance on the best investment strategies. They have a wide range of products, including gold, silver, platinum, and palladium coins and bars, as well as numismatic coins. With such a diversified portfolio, Birch Gold Group is an excellent candidate for those seeking a reputable gold IRA company.

Clients report high satisfaction with Birch Gold Group’s services, and the company has an A+ rating with the Better Business Bureau.

Those interested in investing in precious metals IRAs using Birch Gold Group can contact the company directly or sign up for a free info kit on the company’s website.

Don’t forget to check out our other company reviews including Goldco company review, Augusta Precious Metals company review, and Regal Assets company review.

The owners of this website may be paid to recommend Birch Gold Group. The content on this website, including any positive reviews of Birch Gold Group and other reviews, may not be neutral or independent.

You can view Peter's Author page here.